Why U.S. Health Care Premiums Are Rising – and What Can Be Done

Do you have sticker shock?

I do. My family’s premiums are increasing by nearly $10,000 next year.

And I’m not unique. Health insurance premiums in the United States are rising at a concerning rate for families, employers, and public health professionals. From a public health standpoint, increasing premiums reveals deeper issues in how our healthcare system operates, who gets left behind, and where policy actions could make a difference. So, why are premiums increasing, what does it mean for public health, and what can be done to control them?

What do we mean by “premium” and why do we care?

A premium is the amount you (or your employer) pay each month for health insurance coverage. When premiums increase, two things follow: people may find coverage unaffordable and may skip or delay needed care, and insurers may adjust benefits, deductibles, or networks to compensate. Plans that have high premiums reduce access, delay care, and shift health burdens onto vulnerable populations.

Polling shows that many U.S. adults, even those with insurance, worry about affording their monthly premiums, and some skip care or prescriptions because of cost. Therefore, the trend in premiums has a significant impact on health outcomes, equity, and system sustainability.

Nine major drivers of premium increases

1. Medical price inflation

Healthcare services cost more over time, including hospital stays, doctor visits, diagnostics, procedures, and equipment. When insurers pay more for these services, those costs are passed on to consumers through higher premiums. Prices rise partly because services are being used more frequently, wages for healthcare workers are increasing, new technologies are expensive to adopt, and facility costs continue to rise. When these prices grow faster than wages or household income, the affordability gap widens, making it more difficult for low-income groups to access the necessary care.

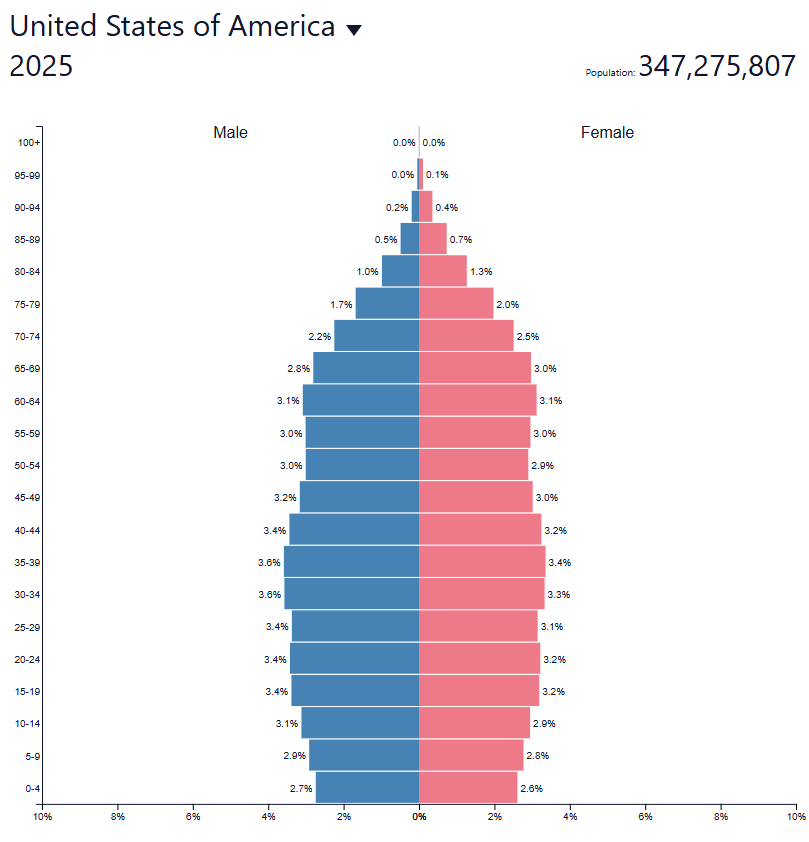

2. Growing and aging population with chronic disease

As the U.S. population ages and more people live with chronic conditions such as diabetes, heart disease, and arthritis, overall health-care use increases. Older and sicker populations are more expensive to cover, which raises average costs within insurance pools and drives up premiums. These premium hikes tend to hit hardest those already at risk, like older adults, individuals with chronic illnesses, and lower-income groups who may struggle the most to afford coverage.

3. Increased use of high‐cost drugs and treatments

New therapies, especially specialty drugs and high-tech treatments, come with extremely high price tags, and insurers identify these costs as major drivers of rising premiums. Some next-generation drugs can cost hundreds of thousands of dollars for a single treatment. While these innovations hold great promise for improving outcomes, they also raise serious equity concerns about whether all patients will benefit or only those who can afford access.

4. Increased utilization of services

When people utilize more healthcare services, such as additional visits, tests, or procedures, the overall cost burden increases. Utilization increases when more people have coverage, when more services become available, or when individuals delay seeking care and ultimately need more intensive interventions. Encouraging preventive care can help reduce the use of costly services, but as premiums continue to rise, many people may skip early care altogether, leading to worse health outcomes in the long run.

5. Market dynamics – fewer insurers, provider consolidation

When insurance markets become more concentrated, with fewer companies, or when hospitals and health systems consolidate, competition decreases, and prices tend to rise. Less competition means less pressure to keep costs in check, which leads to higher premiums and reduced affordability, particularly in underserved or rural communities where options are already limited.

6. Inflation and input costs

When insurance markets become more concentrated, with fewer companies, or when hospitals and health systems consolidate, competition decreases and prices tend to rise. Less competition means less pressure to keep costs in check, which leads to higher premiums and reduced affordability, particularly in underserved or rural communities where options are already limited.

7. Risk pool shifts and adverse selection

Insurance works best when risk is shared broadly across both healthy and less healthy individuals, creating a stable pool where the costs of care are balanced. However, when healthier people drop out or choose not to enroll (often because they view premiums as too high or unnecessary), the remaining pool becomes sicker and more expensive to cover. This imbalance forces insurers to raise premiums even further, which in turn drives out more healthy participants in a self-reinforcing cycle known as a “death spiral.”

In this scenario, the insurance market can quickly become unsustainable: as premiums climb, participation declines, and costs concentrate among those who most need care. The end result is that coverage options become more limited, and insurers may exit the market. Thus, consumers, especially those with limited means or preexisting conditions, face fewer choices and higher barriers to maintaining essential health insurance.

8. Policy and subsidy changes

Changes in laws, subsidies, and tax credits have a significant impact on health insurance premiums in the U.S. For example, the temporary “enhanced” premium tax credits under the American Rescue Plan Act of 2021 (ARPA) and subsequently the Inflation Reduction Act dramatically lowered premium costs for many people in the Affordable Care Act (ACA) marketplace. If those enhanced credits expire at the end of 2025 as scheduled (and one of the major disagreements driving the government shutdown), many market participants may experience significant premium increases and even lose coverage altogether. In short, policy stability and thoughtful program design are crucial for maintaining affordable coverage and preventing sudden premium spikes that can erode access and equity.

9. Waste, inefficiency, and administrative costs

A significant portion of healthcare spending stems from inefficiencies, including duplicate services, administrative overhead, billing complexity, and a lack of transparency. Streamlining administrative processes, improving coordination, and reducing waste can help control cost growth and make the health system more efficient and sustainable.

Putting it all together: the premium rise story

All these factors combine to create a cycle that continually drives health insurance premiums higher. Health care providers charge more due to inflation, advanced medical technologies, and rising wages, while patients, especially older adults and those with chronic conditions, require more care. As a result, insurance companies face increasing costs and respond by raising premiums. Policy or subsidy changes can further exacerbate these increases or shift a greater portion of the financial burden to consumers. When premiums rise, some people opt out of coverage or delay seeking care, which worsens the overall risk pool and pushes costs even higher. Ultimately, high premiums reduce access to care, delay treatment, worsen health outcomes, and deepen inequities. As one report notes, “growth in health care prices stood out as a key factor driving costs,” and for 2026, insurers in the individual marketplace are requesting a median increase of about 18%, driven by higher medical expenses and a sicker risk pool.

Why this matters from a public health point of view

Rising health insurance premiums have far-reaching consequences for individuals and the broader public health system.

First, access to care is threatened as more people become uninsured or underinsured; those without coverage often skip preventive services and rely on costly emergency care, raising population-wide health risks. Second, there are serious health equity concerns, as low-income groups, racial and ethnic minorities, and younger adults are particularly vulnerable to rising premiums. In fact, nearly 44% of insured and uninsured adults under 65 report difficulty affording health-care costs.

Third, preventive care suffers because higher premiums and cost-sharing discourage people from seeking early treatment, leading to a greater burden of chronic disease and more expensive late-stage interventions. Fourth, as families spend more on premiums, they may cut back on essentials like food and housing, which can negatively affect the social determinants of health. Meanwhile, employers facing higher benefit costs may limit wages or hiring. Finally, if premium growth continues unchecked, the overall system becomes less sustainable, resulting in increased costs for government programs and reduced access to private coverage.

What can be done — practical public‐health & policy tips

For individuals/families

- Shop plans annually, especially on the ACA Marketplace, where premiums and benefits change; comparing options matters. (easier said than done, I know)

- Maximize subsidies: For those eligible, tax credits and subsidies can reduce the premium burden; staying informed helps.

- Utilize preventive care: Early treatment can help prevent progression to high-cost conditions.

- Advocate for transparency: Ask providers and insurers, ‘What are the cost drivers?’ Transparency helps push change.

For employers/health‐plan sponsors

- Promote wellness & chronic‐disease management: Reducing high‐cost chronic conditions can improve the risk pool and mitigate premium growth over time.

- Work on benefit design: Balanced cost-sharing, robust provider networks, and value-based care can help contain costs.

- Engage employees on healthcare literacy: Help workers understand how premiums work, how to use benefits efficiently.

For policymakers & public health leaders

- Support policy to stabilize risk pools: For example, subsidies to keep healthy people enrolled in marketplaces help.

- Promote competition: Monitor market consolidation of insurers and providers; encourage alternative models (public options, non-profit plans) where feasible.

- Control drug/technology prices: High-cost drugs and tech are major drivers; policy levers (negotiation, generics, value‐based pricing) matter.

- Tackle inefficiency & waste: Promote transparency in pricing, reduce duplicate services, streamline administration.

- Invest in public health & prevention: Less disease burden equals lower costs downstream; healthier populations → lower premiums and slower growth.

Consider the upcoming 2026 premium filings for ACA marketplace plans: Insurers have requested a median increase of ~18%, citing higher medical costs and sicker populations. If subsidised tax credits expire, many households could face much steeper burdens. This suggests a strong interplay between public policy (subsidies) and market dynamics (risk pool, costs).

In other words, policy changes can amplify or moderate cost pressures. The public health sector must monitor not just health‐care delivery but also the financial access side.

Final thoughts

Rising health-insurance premiums in the U.S. are not a mystery. They stem from a combination of rising costs, aging and sicker populations, breakthroughs (which are beneficial but expensive), market structure, policy design, and utilization patterns. From a public health viewpoint, this is a major concern because it threatens access, equity, and health outcomes.

However, there is hope: by focusing on prevention, chronic disease management, transparent pricing, stable policy subsidies, and competition in insurance and provider markets, we can work to mitigate premium growth. Public health professionals should view premium trends as an essential part of the well-being ecosystem, not just as cost metrics, but as access and equity signals.