1 in 4 ‘Gambling-Traders’ Show Signs of Gambling Disorder

TL;DR: A new study reveals that some retail investors blur the lines between gambling and trading—especially younger men drawn to cryptocurrency and high-frequency trading. One in four in this “gambling-trader” group shows signs of gambling disorder.

Picture this: A 32-year-old man opens a trading app on his phone. Before finishing his coffee, he’s bought and sold Bitcoin twice, bet on a soccer match, and purchased loot boxes in a video game. He’s not a Wall Street pro—or even a gambler in the traditional sense. But his brain? It might not know the difference.

A new Spanish population-based study sheds light on a growing trend: the fusion of retail trading and gambling behaviors. And for a sizable portion of everyday investors, it’s more than just a hobby—it’s a risky, impulsive cycle that mirrors problem gambling.

In fact, nearly 25% of one investor subgroup exhibited signs of gambling disorder. Let’s unpack what this means, why it matters, and what public health experts should be paying close attention to.

Three Types of Retail Investors—And One Big Red Flag

The researchers analyzed data from 1,429 Spanish adults aged 18 to 64, focusing on 403 non-professional “retail investors” who had traded in the past year. Using a method called latent class analysis, they identified three distinct types:

1. Crypto-Traders (52.4%)

These folks mostly dabbled in cryptocurrency. They rarely gambled outside of an occasional lottery ticket. They also showed low levels of impulsivity or risky behavior.

2. Stock-Traders (32%)

Focused on traditional investments like stocks and ETFs. They participated in gambling at moderate rates, mostly sticking to lotteries and land-based options.

3. Gambling-Traders (15.6%)

This is where the warning bells ring. These investors traded a wider range of high-risk assets (crypto, Forex, commodities) and engaged in multiple gambling activities, from sports betting to in-game loot boxes. They traded more often, monitored markets obsessively, and scored off the charts on impulsivity and cognitive distortions—both hallmark traits of gambling disorder.

And here’s the kicker: Nearly 1 in 4 gambling-traders met clinical criteria for problem gambling, compared to just 0.5% of crypto-traders and 3.5% of stock-traders.

Why It Matters Now

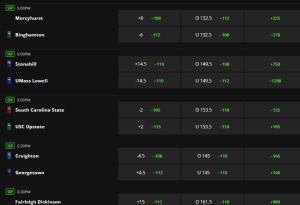

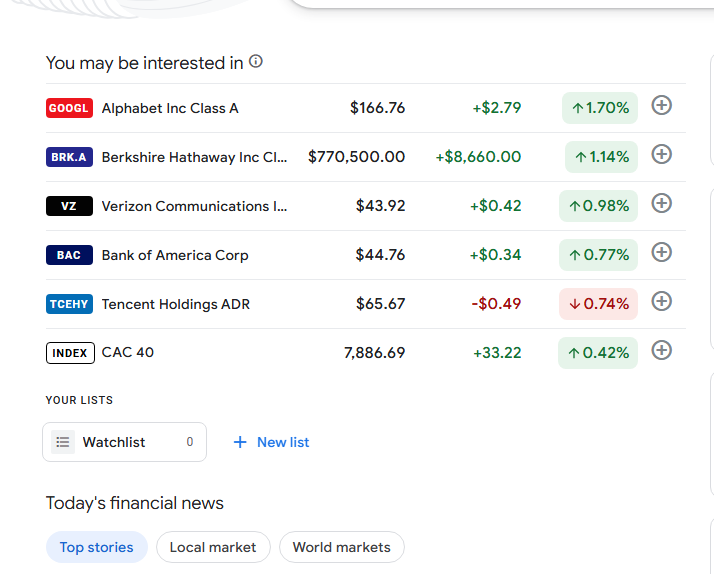

The rise of platforms like eToro and Robinhood has gamified investing. With sleek interfaces, push notifications, and social features, trading has never been more accessible—or more addictive.

While many treat investing as a serious financial strategy, others use it as a form of entertainment or escape, similar to how some use casinos. This blurring of boundaries between trading and gambling poses new public health challenges.

Especially at risk are young men, often tech-savvy and financially literate, but also more impulsive, more likely to use substances, and more drawn to high-risk, short-term trading strategies like day trading or scalping.

Is Trading the New Gambling?

There are striking similarities between speculative trading and online gambling:

- Both involve quick decisions under uncertainty.

- Both trigger dopamine surges linked to wins (or near-misses).

- Both can be accessed 24/7 from a smartphone.

- And both can spiral into compulsive behavior.

What’s more, trading frequency, shorter holding times, and market obsession were strongly linked to disordered behavior—regardless of the actual amount of money being invested. Just like gambling, it’s not about how much you spend, but how often you play and why you play.

Public Health Implications

This research provides actionable insights for mental health professionals, public health agencies, and financial regulators:

- Screening for gambling disorder should include questions about trading—especially among young adults and men.

- Trading apps may need built-in protections, like timeouts, spending limits, or reality checks (similar to what online gambling sites offer).

- Financial education efforts should go beyond “risk and reward” to include discussions about behavioral addiction and cognitive biases.

Perhaps most urgently, we need to recognize that gambling is evolving. It’s no longer confined to casinos and sportsbooks. For many, it’s happening on financial apps that don’t look like games—but feel like them.

What’s Next?

While this was a cross-sectional study, the patterns are striking enough to demand follow-up. Future research could:

- Track investor behavior over time to see who develops problems and why.

- Examine how market trends (like crypto booms) affect risky trading.

- Evaluate the effectiveness of harm reduction features in trading platforms.

Join the Conversation

Public health has a new frontier—one that lives in the overlap of finance, psychology, and tech.

- Have you observed this “gamblification” of trading in your own community or network?

- Should trading platforms be regulated like gambling sites?

- How might we better support individuals caught in these risky feedback loops?

Let us know what you think—and help spread awareness before the next bubble bursts.