Crowdfunding Health Care: A Symptom of a Broken System

Scanning social media today, you might see a heartfelt plea for help with medical bills – a friend of a friend raising money for cancer treatment, or a local family seeking support after a devastating accident. Such personal crowdfunding campaigns for healthcare have become quite common in the United States. Over the past decade, what started as a small number of online medical fundraisers has grown into a widespread trend, exposing troubling gaps in the healthcare system even as it provides a lifeline to those with nowhere else to turn.

The Rapid Growth of Medical Crowdfunding in the U.S.

Online crowdfunding for medical expenses has significantly increased in recent years. Platforms like GoFundMe, YouCaring (now part of GoFundMe), and others have collectively raised billions of dollars for Americans facing health-related costs. Medical fundraisers now represent one of the largest categories on major crowdfunding sites. For example, GoFundMe – the largest platform for personal crowdfunding – reported that approximately one-third of all donations are directed toward healthcare needs, totaling around $650 million annually for medical campaigns. Each year, more than 250,000 medical campaigns are launched on GoFundMe alone. What was once an occasional last resort has become almost routine: millions of Americans have created or contributed to online fundraisers to cover medical bills in recent years.

This growth is not just in dollars raised but also in overall visibility. High-profile cases periodically make headlines – from crowdfunding for cutting-edge experimental treatments to communities rallying online after a neighbor’s tragic accident. The trend gained momentum during the 2010s and shows little indication of slowing down. By the late 2010s, observers noted that medical crowdfunding had effectively become “the nation’s safety net of last resort” for many patients. With no comprehensive health coverage, Americans have increasingly turned to the crowd. Dozens of new campaigns are posted daily for a wide range of needs, from cancer care and transplant surgeries to surprise ER bills and physical therapy sessions.

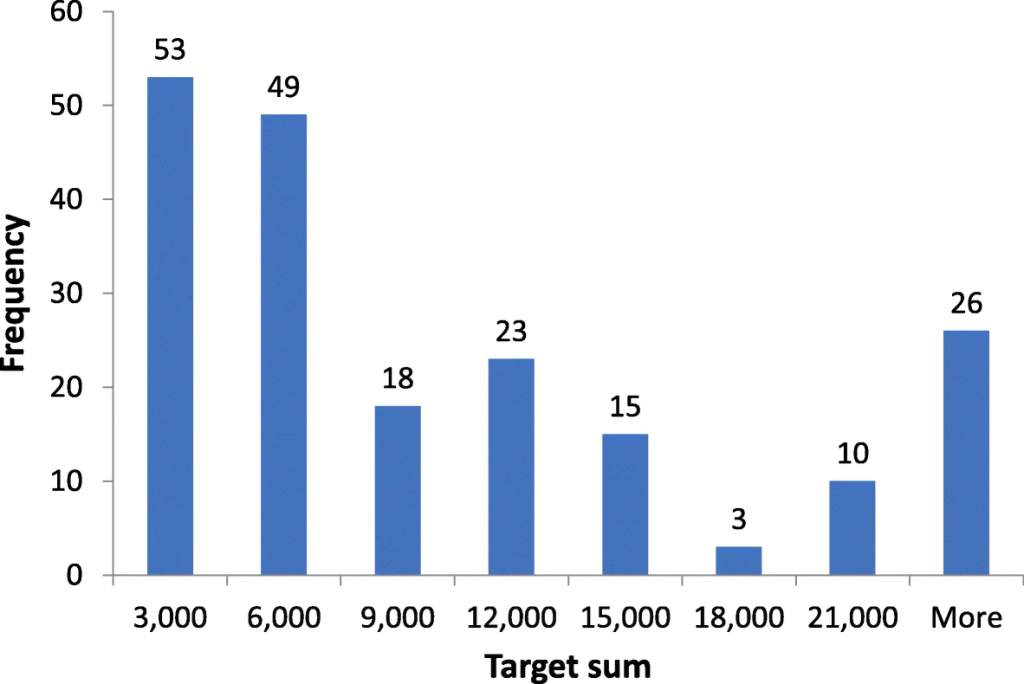

Yet amid rapid growth, success remains uncertain. Most medical crowdfunding campaigns struggle to meet their financial goals. Analyses show that only about 10% of campaigns reach their target, with many raising only a small portion of what’s needed. The visibility of a few large successes can hide the fact that for every headline-making fundraiser that collects tens of thousands of dollars, countless others attract little attention. The median campaign raises only around 25–40% of its goal, leaving many patients still heavily in debt. Despite these challenges, the number of people turning to crowdfunding continues to increase each year.

Who Is Turning to Crowdfunding – and Why?

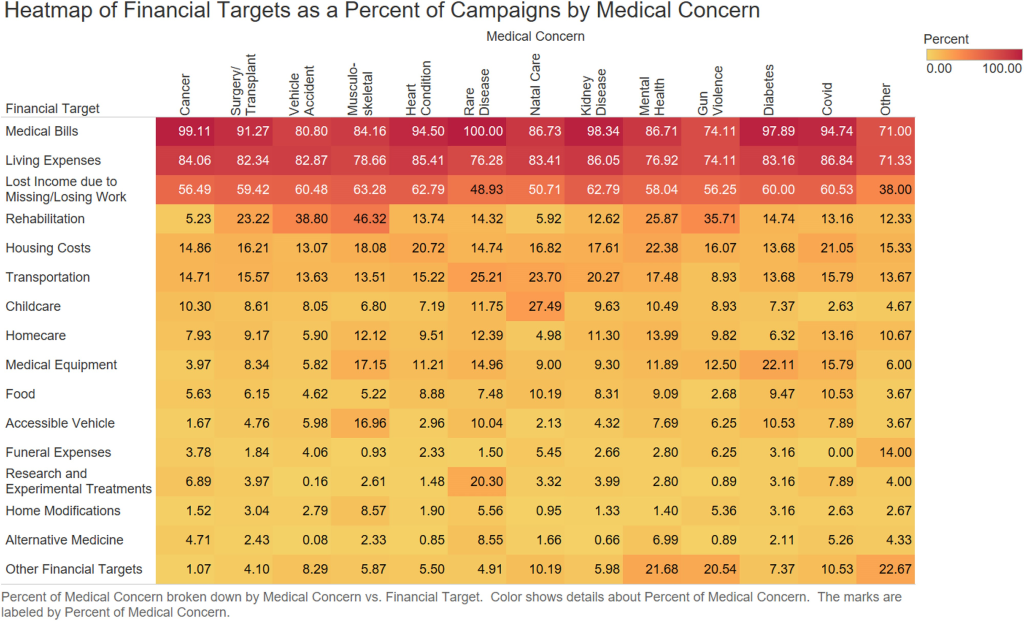

Medical crowdfunding encompasses a wide range of patients and conditions, but certain patterns are evident. Patients fighting serious illnesses like cancer are among the most common organizers and beneficiaries of crowdfunding. Cancer treatments—often costly and lengthy—regularly top the list of reasons for crowdfunding. Campaigns to pay for catastrophic injuries (such as from accidents or violence), organ transplants, and rare diseases are also prevalent. Families of critically ill children frequently use crowdfunding to afford specialized care or out-of-network providers. Even more routine medical needs can inspire fundraisers if patients lack insurance coverage—for example, some have sought donations for insulin and medical supplies, dental procedures, or physical therapy that insurance wouldn’t cover.

Demographically, crowdfunding users come from all backgrounds, but there is a tendency toward younger, internet-savvy individuals and middle-class people who do not qualify for public aid but face financial hardships. Often, it is friends or family members of a sick person who create the campaign on their behalf. Studies have shown that certain factors can influence success: patients who tell a compelling personal story, have supportive social networks, or receive media coverage tend to raise more funds. This suggests that crowdfunding might favor those who are already relatively privileged—people with larger social circles or better resources to promote their campaigns—while individuals from marginalized communities may find it more difficult to reach their funding goals. For instance, research indicates that campaigns for patients in affluent ZIP codes raise considerably more on average than those in low-income areas, highlighting a digital divide in who benefits most from crowdfunding.

Lublóy, Á. Medical crowdfunding in a healthcare system with universal coverage: an exploratory study. BMC Public Health 20, 1672 (2020). https://doi.org/10.1186/s12889-020-09693-3

Almost every campaign has a common story: someone facing medical bills they can’t afford through traditional means. Whether it’s an uninsured gig worker injured in a car crash, a schoolteacher with insurance maxed out by cancer treatments, or parents confronting lifelong care costs for a disabled child, the profiles differ, but the core issue is usually a healthcare expense beyond what the person can pay.

A Symptom of Gaps in Health Coverage and Affordability

The rise of medical crowdfunding highlights significant gaps in the U.S. healthcare system and the affordability crisis. The United States is the only industrialized country without universal health coverage, leaving about 30 million Americans uninsured as of the mid-2020s. Even among those with insurance, many face plans with high deductibles and copays that result in substantial out-of-pocket expenses. In 2022, the average deductible for a single person with employer-sponsored insurance exceeded $1,600 – an amount that can be unaffordable for lower-income families. Just a few medical bills or a costly prescription can quickly overwhelm a family’s finances. One survey found that 40% of Americans would struggle to pay an unexpected $400 expense, illustrating how unprepared many households are for medical emergencies.

Given this reality, it’s perhaps no surprise that medical bills are a leading cause of personal financial strain. Medical debt is alarmingly common: an estimated 17% of Americans had medical debt in collections in recent years, and more than half report going into debt or depleting savings because of medical or dental bills. Unpaid medical bills make up a large part of personal bankruptcies in the U.S. This unmet need drives many people to seek help on crowdfunding platforms when all else fails.

Crowdfunding campaigns humanize the statistics by showing individual stories. Each one highlights someone slipping through the cracks—perhaps their insurance denied a lifesaving treatment, they face exorbitant out-of-network charges for a specialist, or they simply can’t afford the co-pays for a chronic illness.

Collectively, these stories reveal systemic issues. As one health policy expert said, “Relying on GoFundMe to fill gaps in health coverage is a sign of a failing safety net.” Even the CEO of GoFundMe has expressed dismay, noting he was “horrified that GoFundMe was being used to pay for healthcare at all,” emphasizing that his platform cannot and should not replace a functioning healthcare system. The widespread reliance on crowdfunding for basic medical needs essentially indicts how unaffordable healthcare remains for many Americans.

Global Perspectives: Crowdfunding Healthcare Around the World

While the United States relies most heavily on medical crowdfunding, it is not alone in this trend. In countries with universal healthcare systems, medical crowdfunding also exists, although it mainly focuses on areas where public coverage is insufficient. For example, in Canada—which has single-payer healthcare for core medical services—residents still turn to crowdfunding to afford things like out-of-country treatments, prescription drugs not covered by provincial plans, rehabilitation services, or dental care, which is often not included in Canada’s public health system. One analysis found that Canadians launched thousands of health-related crowdfunding campaigns in a single year, collectively raising tens of millions of dollars for medical needs that the public system didn’t fully meet. Similar patterns are seen in the United Kingdom, where the National Health Service covers most medical costs. British patients have used crowdfunding to access experimental therapies or cancer drugs not approved by the NHS, or to seek private care in hopes of shorter wait times. These cases often make news in the UK, sparking debates about whether the NHS should fund certain high-cost treatments.

In lower-income countries and those lacking robust health safety nets, crowdfunding is also on the rise, typically to cover the costs of major surgeries or treatments abroad. Platforms dedicated to medical fundraising have emerged worldwide – for example, India’s crowdfunding sites have hosted numerous campaigns for expensive surgeries, reflecting the burden of out-of-pocket medical expenses in the country. China has even experienced the rise of large crowdfunding portals like Shuidichou (“water drop fund”), which, by the late 2010s, had hundreds of millions of users pooling small donations for individuals’ medical bills. These global examples highlight a common theme: when official systems fall short, people turn to the public’s generosity to fill the gap. However, in countries with stronger health coverage, the scope of crowdfunding is generally much more limited than in the U.S. – often restricted to extraordinary cases or additional needs. The widespread reliance on crowdfunding for routine medical bills, as seen in the U.S., remains a clear exception on the world stage.

Policy Solutions: Reducing the Need for Medical Crowdfunding

Medical crowdfunding can be a vital stopgap for individuals, but it is not a long-term solution to healthcare affordability. As this practice has expanded, policymakers and experts are exploring ways to reduce Americans’ reliance on online charity for essential care. Addressing the underlying causes will require reforms in the health system. Here are several potential policy solutions that could ease the pressures that lead people to crowdfund their medical bills.

- Expand Health Insurance Coverage: Closing the insurance gap is essential. Policies could include expanding Medicaid in every state, increasing subsidies for Affordable Care Act marketplace plans, or even adopting a universal coverage system. The aim would be to reduce the number of people who are completely uninsured and at risk of catastrophic costs.

- Limit Out-of-Pocket Costs: For those with insurance, stricter limits on deductibles and maximum out-of-pocket expenses can prevent overwhelming medical bills. Caps on cost-sharing and requiring coverage of essential health benefits with minimal patient costs would reduce unexpected gaps. Some proposals suggest capping annual out-of-pocket spending as a percentage of income to protect families from financial ruin.

- Regulate Medical Pricing and Billing: Surging prices for hospital services and prescription drugs push many to desperation. Reforms could focus on drug pricing transparency and negotiation, limits on hospital charge markups, and banning predatory practices like surprise out-of-network billing. Reducing the overall cost of care directly lessens the need to seek outside funds.

- Strengthen Medical Debt Protections: Implement policies to forgive or reduce medical debt, as well as provide no-interest payment plans and financial aid, to support those already struggling. Better enforcement of nonprofit hospitals’ obligation to offer charity care and credit-reporting protections for medical debt would prevent many from having to seek help online.

- Emergency Relief Funds and Social Safety Nets: Some experts suggest creating public or non-profit catastrophic medical relief funds. These could serve as a safety net for cases of extreme need – essentially an organized charity or government program to handle what now often ends up on GoFundMe. Enhancing social services (like disability support, caregiver help, and income support during illness) would also lessen the financial shock that currently drives people to crowdfunding.

By making these changes, the goal is to shift the story, from Americans feeling their best hope for affording healthcare is to turn to strangers on the internet, to one where a strong healthcare system supports them when they need it. No one should have to become a fundraiser to survive an illness, and the current dependence on crowdfunding is widely seen as a sign of policy choices that can be changed. Reducing the need for medical crowdfunding will ultimately require strengthening the healthcare infrastructure so that paying for care isn’t left up to charity.

In conclusion, the rise of medical crowdfunding in the United States is a vivid reflection of the country’s healthcare challenges. Each fundraiser shared tells a story of both community compassion and systemic failure. Crowdfunding has undoubtedly helped many families avoid financial disaster or obtain treatment they otherwise could not afford, highlighting the generosity and solidarity among ordinary people.

However, as a de facto healthcare solution, crowdfunding is inherently incomplete and unfair. Many argue that a modern, civilized society should not have to rely on virtual bake sales to fund its healthcare. The increasing frequency of these campaigns signals an urgent call to policymakers: to ensure that future critical health needs are addressed through proactive policy, not by passing the digital collection plate.